3. The New System and Communication Options

The changes introduced to border control functions as a result of the CMR project involve4 :

• A new open gateway communication system known as Customs Connect Facility (CCF)

• The merger of several computer systems into an Integrated Cargo System (ICS)

• Tailored arrangements for low-risk importers and exporters under an accredited client program

• Industry self-assessment of low-revenue, low-risk cargo; and

• Streamlined reporting mechanisms that combine cargo reports and declaration information.

Import Declarations

This section concentrates on consignments requiring the lodgement of a formal import declaration, because their customs value is above Australian Dollars (AUD) 1000. Consignments with a customs value of AUD 1000 or less are cleared through a Self Assessed Clearance Declaration (SAC). SAC will be discussed later in the paper.

Before examining the communication options, it is important to note that there has been shift in the wording on commonly used forms under the new system, by the replacement of the word “entry” with the word “declaration”. For example the (old) Entry for Home Consumption (Nature 10) form (B616) has been replaced with a new form (B650) entitled Import Declaration (N10). The changes to the wording have also been consistently applied to the Customs Act5 , for example in section 71A Making an Import Declaration. The rationale behind the change appears to have been driven by the desire to increase the accountability of persons providing information to the ACS, regardless of the chosen mode communication.

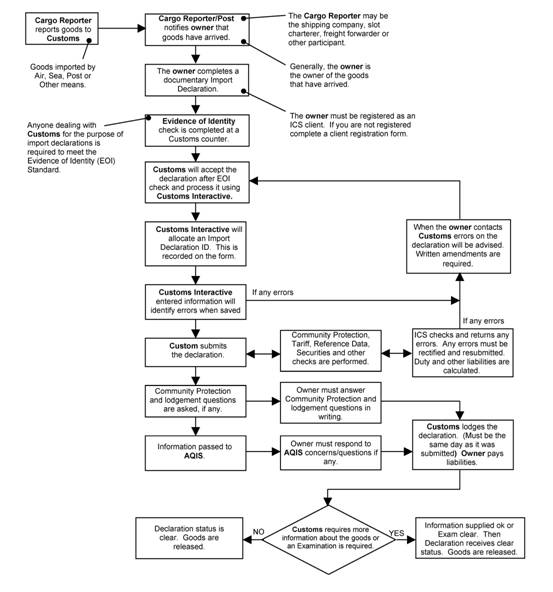

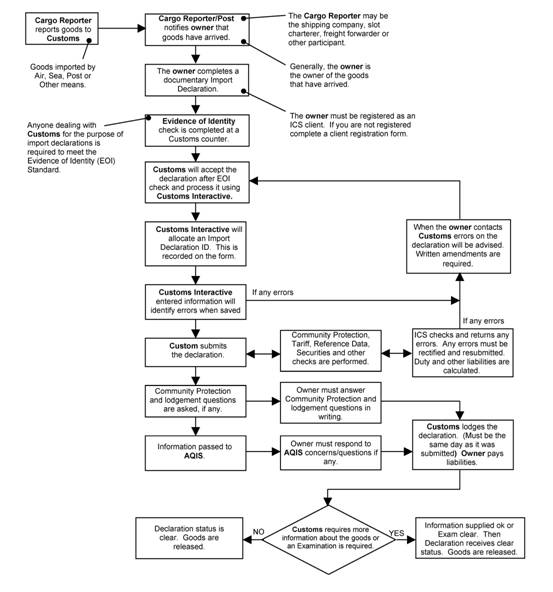

The diagramatic flow of the new Import Declaration Process is shown at Figure 2 below6 . The most important aspects of this diagram will be considered below from a user’s perspective.

Effective 12 October 2005, faxed and mailed import documents for importing cargo are no longer accepted by the ACS. Under the new system, there are three options for submitting declarations to the ACS7 that are open to users:

a) Manual lodgement of import entries.

Manual lodgement of import declarations may be undertaken at ACS offices. This option requires that an Evidence Of Identity (EOI) check be conducted for every lodgement8 . The EOI is the customary 100 point check that enables the verification of an individual’s identity against a range of acceptable documents, that must include the individual’s current address. These documents may be:

- a primary document (70 points each), such as birth certificate or passport, and

- one or more secondary documents (40 points each), such as driver’s licence or shooter’s permit. These types of documents must include the signature or photograph of the individual subject to the EOI, where the primary document does not include a current photograph. For example a person’s birth certificate does not include a current photograph, so the secondary document must include a current photograph.

- Other documents (35 or 25 points each depending of the type of document), such as rate notices or credit cards.

The complete list of acceptable EOI documents is available from the ACS.

Figure 2: The Import Declaration Process

Counsel advising the client should emphasise that the processing of documents can only occur after the EOI check has been completed. Counsel should also be aware and communicate to the client, that the manual lodgement of import declarations may result in a considerable financial burden to the business through time lost in commuting to and from the ACS offices, plus the time

required for the paperwork to be processed. Currently the service standards from the ACS for manual declarations is

the close of business of the next working day after receipt of a complete and accurate import declaration 9

The delays in processing manual declaration may have downstream logistical implications for the client. Counsel should ensure that the client understands the financial outlay required in pursuing the manual import declaration option and should suggest that accurate costing be undertaken to identify the cost versus benefit.

It should be noted that a person wishing to lodge import declarations manually has the option of outsourcing the physical lodgement of documents through the services of a courier. However this option requires prior approval from the ACS and must provide ahead of time the identification of the person lodging the documents, and that person must also be able to satisfy the EOI requirements. Counsel should be aware that the onerous obligations placed on prior identification of the courier and approval by ACS will, in the vast majority of circumstances, make it practically impossible for this option to be pursued. Indeed the use of couriers is underpinned by flexibility, but it seems that this aspect has been severely hampered by these compliance requirements.

|